As promised in the flyer, the Association of Laser Users (AILU) event brought together a mix of additive manufacturing (AM) experts from industry and academia to discuss the tough topics that are all too often ignored in the media hype surrounding 3D printing. Split into four sessions, the meeting was chaired by Robert Scudamore from manufacturing and fabrication consultants TWI.

Setting the scene

The aerospace sector is a prime candidate for lightweight, lattice structures that are easy to build using AM tools. Also, 3D printers enable a high-level of part customization, which benefits medical implants and patient-specific surgical tools. But both aerospace and medical sectors require significant materials and process qualification.

Also, there are setup costs to factor in. Additive techniques such as 3D printing use much less material than subtractive processes such as milling, but the initial materials outlay can still be high. For example, filling an industrial laser sintering machine with virgin titanium powder can cost thousands of pounds.

Speed of production is another issue, with some parts taking hundreds of hours to build.

Reality check

One of the first speakers to start busting the myths was Robin Wilson from the UK’s Technology Strategy Board (TSB). “Additive manufacturing is not just printing from CAD,” he told delegates. Potential users need to consider the whole process, which as Wilson points out involves a significant “digital data supply chain” and physical “post-processing” of the finished component.

Stéphane Abed of Poly-Shape, who also spoke at the meeting, manufactures parts using a tool path that co-ordinates four beams. These multiple lasers can build several smaller components at once or construct different sections of a single work-piece simultaneously, to improve production rates. But having multiple optical-trains also ramps up the number of variables in the process.

Listening to the presentations, it’s clear that AM has no shortage of parameters that influence the quality of the manufactured part – laser power, writing speed, powder flow rate (for nozzle-blown setups), particle size distribution and recycle rate, are just a few.

It can be done

Throughout the day, process control remained a key talking point. Trevor Illston of Materials Solutions, who led the final session of talks, is optimistic that AM can be controlled to a “production standard” by inspecting workpieces at multiple points in the AM process.

Giving the audience food for thought, Illston added that there can be a downside to the design freedom that 3D printing brings to the table, as it’s possible to create parts that are incredibly difficult to examine!

In general though, unlocking traditional design constraints is a big win for AM – and despite the production challenges, all of the speakers recognized that major opportunities are up for grabs.

The medical sector is a growth area for AM, not just for implants, but also for custom tools such as cutting blocks to guide surgery. Medical centres are looking at options for manufacturing parts in hospital to speed up delivery to the patient. Ideas here include flat-packed production tools that can be sterilized and then assembled in theatre.

“AM often solves one problem beautifully, but it can create other issues,” said Edward Draper of JRI Orthopaedics, who spoke in the opening session. Draper picked up on Wilson’s earlier remark about post-build processing, and emphasised the requirement for cleaning and polishing.

Something new

Images of medical devices, helicopter components and fixtures for satellites are becoming a familiar sight at AM conferences and events, but Neil Burns of Croft Engineering had something new for the audience – filtration parts. Traditionally, Croft Engineering has made filtration supports by shaping wire mesh, but the bending process leads to apertures that are non-uniform. To get around this, Burns showed how his company uses AM (inspired by a trip to Fab Lab in Manchester, UK) to build filtration supports with holes that are aligned to the direction of fluid flow – a design feature that saves customers money by reducing the amount of energy that’s required to pump liquid through the component. Despite the benefits, Burns revealed that clients can be cautious about using AM parts. They fear downtime caused by mechanical failure.

But what is the effect of AM on materials performance? How do AM samples behave under load compared with material that has been cast or milled? AM components might look fine on the outside, but what’s happening to the internal structure of the material? Also, how does the strength of parts made using different machines compare, or parts that are built on the same machine, but formed using a different tool path, or using powders with a different particle size distribution or storage history?

Team effort

To tackle this, AM needs its own materials database and standards – a point made by many attendees, including Neil Mantle of Rolls-Royce. What’s more, the task requires a collaborative effort. Contributions so far include EU initiatives such as SASAM (Support Action for Standardisation in Additive Manufacturing) and the UK’s ANVIL project to establish benchmarks and design guides for AM.

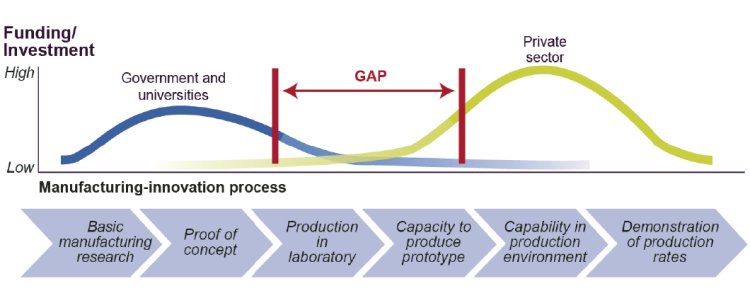

A continuing development is the use of technology hubs to support AM projects at technology readiness levels (TRL) 4-6, or in other words to translate projects from proof-of-concept to pilot-scale operation.

David Wimpenny from the UK’s Manufacturing Technology Centre (MTC), which was established in 2010 to bridge the gap between academia and industry, was at the event. “Our role is to make parts that industry can relate to in terms of size and quality,” he explained.

Today, the MTC is part of the UK’s high value manufacturing (HVM) catapult – a network of seven technology centres with a shared goal of accelerating process innovation.

Related links –

Metal Additive Manufacturing: opportunities in applications and improvements in process technology (full programme)