The touch panel sector, which has been growing explosively over the past decade, offers tremendous opportunities for new materials and next-generation technologies, but only if developers can accurately grasp market requirements, and identify the sweet spots for their products and services. Jennifer Colegrove, industry analyst and founder of Touch Display Research, has been covering the market in detail since 2006. In this guest post for TMR+, she looks at how the sector has matured, explains why ITO transparent conductive films (TCFs) remain dominant despite their disadvantages and assesses the prospects for new materials.

Overview 2006 – 2020

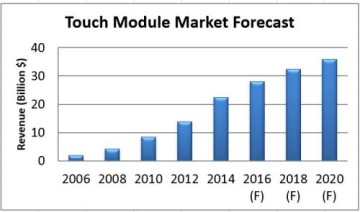

Touch Display Research forecasts that the touch module revenue will reach $36 billion by 2020, from just $2 billion in 2006.

Figure 1. Touch Module Market Forecast (Image credit: Touch Display Research).

Touch screen suppliers, especially those providing projected capacitive touch modules – a popular choice for smart phones and tablets as the technology supports multi-touch gestures – have been mostly profitable during 2007 and 2009. But fast forward to 2016 and the competition is fierce with many touch screen suppliers encountering net losses in recent years as manufacturing capacity has outstripped demand, pushing down panel prices. To become a leader or maintain a leadership position in today’s touch industry, providers need to enhance their offering to customers and introduce new features to drive profits.

ITO-replacement: Non-ITO transparent conductors

ITO remains the mainstream transparent conductor used on touch panels, and this mature technology will likely dominate the sector for years to come – manufacturers have invested millions of dollars in equipment to serve current markets. But the material comes with some well-known drawbacks such as high-cost, fragility and long processing steps. To overcome these issues and to drive new product categories (and revenue) developers have come up with a range of alternatives. Today, there are over 200 companies or research institutes currently working on ITO-replacements and this activity has become one of the hot trends.

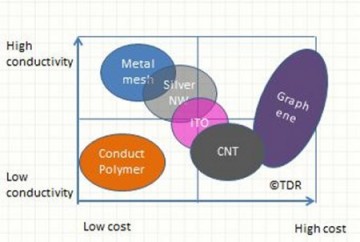

There are over 10 types of ITO replacement technologies; we have placed them into 6 categories: metal mesh, silver nanowire, carbon nanotube, conductive polymer, graphene and other transparent conductor technologies. Each technology has its pros and cons and there are many characteristics to compare when choosing a transparent conductive material such as sheet resistance, transmissivity, conductivity, haze, optical appearance and cost, by way of example.

In the following figure, we compare cost and conductivity.

Figure 2: Comparison of ITO replacements, cost vs conductivity (Image credit: Touch Display Research, ITO-replacement: non ITO transparent conductor technologies, supply chain and market forecast report, 2013, 2014 and 2015).

Supply and demand

In late 2012 and early 2013, the shortage of touch screens for notebooks, ultrabooks and all-in-one (AIO) PCs due to the high demand of touch functionality driven by Microsoft’s Windows 8 software, coupled with the low yield of 10” to 29” ITO touch sensors drove the adoption of ITO-replacements. When many touch panel suppliers ramped up capacity in mid-2013, the shortage became an over-supply toward the end of 2013, which resulted in substantial touch screen module price erosion.

ITO-replacements such as metal mesh, silver nanowire could provide touch sensing at lower cost, thinner, lighter weight, higher conductivity and larger sizes. Our survey found that silver nanowire type touch sensors had good penetration into AIO PC touch screens in 2013 and 2014.

On the other side, the metal mesh touch sensor category faced obstacles such as visible metal lines or reliability issues in 2014 and the first wave faded. However, a second wave of metal mesh has formed in 2015, led by Toppan, Fuji Film and others, and is stronger than before. Metal mesh companies (suppliers + adopters) have increased from 29 firms in 2014 to 42 firms in 2015.

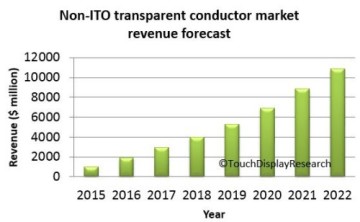

Figure 3. Non-ITO transparent conductor market forecast to 2020 (Image credit: Touch Display Research, ITO-replacement: non ITO transparent conductor technologies, supply chain and market forecast report, May 2015).

Summary and business strategy recommendations

According to our analysis, the touch screen module market is forecast to grow to $36 billion by 2020 from $2 billion in 2006, and will throw up many new opportunities in this fast-changing industry. The revenue contribution from non-ITO transparent conductors is estimated to be in the region of $11 billion by 2022, up from $206 million in 2013.

ITO touch sensor’s shortage and oversupply situation has created opportunities for the ten or more ITO-replacements available. Our recommendations include the use of metal mesh for simpler designs, including tablet PCs, with large volume applications or very large sizes – for example, over 50 inch digital signage; silver nanowires for display and lighting due to their uniformity and diffusing character; conductive polymer for EMI, anti–static applications based on the relatively low cost of the material; and carbon nanotubes or carbon nanobuds for mobile/wearable devices with the benefits of flexibility, low reflections and zero haze.

Biography

Jennifer K. Colegrove is CEO and Principal Analyst at Touch Display Research Inc. – a market research and consulting firm focusing on touch screen and emerging display technologies – based in Santa Clara, USA. Since founding the company, she has advised more than 200 clients on a wide range of topics including touch screens, ITO-replacement, active pen, near-eye displays, flexible displays, OLED displays and lighting, 3D displays, e-paper displays, pocket projectors, gesture control, voice control, and eye control. Jennifer has a PhD from the Liquid Crystal Institute at Kent State University in Ohio. She received both her bachelor’s and master’s degrees with honors from Beijing University.

Jennifer K. Colegrove is CEO and Principal Analyst at Touch Display Research Inc. – a market research and consulting firm focusing on touch screen and emerging display technologies – based in Santa Clara, USA. Since founding the company, she has advised more than 200 clients on a wide range of topics including touch screens, ITO-replacement, active pen, near-eye displays, flexible displays, OLED displays and lighting, 3D displays, e-paper displays, pocket projectors, gesture control, voice control, and eye control. Jennifer has a PhD from the Liquid Crystal Institute at Kent State University in Ohio. She received both her bachelor’s and master’s degrees with honors from Beijing University.

Read next

– Editorial: Market research, market pull (George Grüner)