What are the price points that graphene and its derivatives need to hit to access market opportunities in composites, lubricants, 3D printing, concrete and other target applications? Who are the leading global suppliers and what are the sweet spots for the various grades of the material, which range from few-layer sheets to much larger stacks of graphene nanoplatelets?

Fullerex, an advanced materials and technology brokerage, which works with nanomaterial producers and end-users to support applications development and commercialisation, has set out to answer these questions and more in its annual bulk graphene pricing report, now updated for 2016.

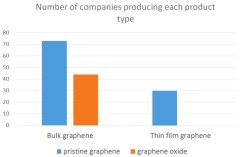

Supply landscape: the number of companies offering bulk graphene compared with providers of thin-film material (source: Fullerex)

Bulk graphene is offered by producers as a functional filler to improve the properties of base materials. These additives can be sold into a wide range of industries, but which sectors offer the strongest prospects for suppliers?

Business case

One of the fastest moving opportunities for graphene producers is the emerging 3D-printing market. Suppliers of FDM 3D printing consumables in Europe and the US are facing competition from Chinese firms producing spools at lower cost. “Established companies need to differentiate their products to protect their margins and nanomaterials provide a way to do this,” Tom Eldridge, director at Fullerex told TMR+. “Adding graphene can make the filament conductive or high strength and expands the number of applications that 3D-printed parts can address.”

With relatively few materials to choose from, the 3D printing community has a healthy appetite for new products to print with, which plays well for graphene producers. The downside is that the volume of nanomaterials required is likely to be relatively low, so graphene suppliers will need to look to larger markets to justify investments in scaling up facilities.

Longer term, one of the biggest opportunities for bulk graphene could be in construction. “Concrete is the second most consumed material after water and represents a potentially huge market for graphene in terms of volume, but it will be much tougher for producers to demand premium prices,” Eldridge points out. “In this sector, it’s essential to get costs down so that your material is as competitive as possible and to achieve a favourable price-to-performance ratio,”

The benefits of adding graphene to concrete include improvements in compressive strength and flexural modulus, but the nanomaterial could also deliver sensor properties and assist in the detection of micro-cracks to monitor the ‘health’ of a structure.

To break into target markets large and small, graphene producers need to get a handle on which applications are going to make the most commercial sense to potential customers. There are other issues too. “Standardization is on everyone’s mind, and is being worked on,” comments Eldridge. “Over a shorter time-frame, consistency from individual suppliers is the key priority to get commercial-use graphene based products and systems onto the market.”

Read next

From the journal Translational Materials Research (TMR) –

What can 2D materials learn from 3D printing?

What can 2D materials learn from 3D printing?

Analysing the trajectory followed by 3D printing suggests commercialization strategies for 2D innovators and could help bring graphene’s unicorn milestone forward by a decade.

Graphene Connect underscores the importance of engaging SMEs in materials commercialization

Graphene Connect underscores the importance of engaging SMEs in materials commercialization

European workshop series aims to accelerate the uptake of new materials by developers and quicken the translation of academic research into products

Lean startup for materials ventures and other science-based ventures: under what conditions is it useful?

Lean startup for materials ventures and other science-based ventures: under what conditions is it useful?

Rainer Harms and his co-authors examine the lean startup approach as a framework for technology entrepreneurship

From composite material technologies to composite products: a cross-sectorial reflection on technology transitions and production capability

From composite material technologies to composite products: a cross-sectorial reflection on technology transitions and production capability

How do composite material technologies create growth and how do the properties of those materials influence production capability and manufacturability?